Mergers and acquisitions (M&A) are critical occasions in the business world that can affect stock costs and market elements. For Nifty merchants and financial backers, the Nifty Option Chain offers a vital asset to exploit potential open doors emerging from M&A exercises in Indian securities trading. By utilizing the data given in the Nifty Option Chain, people can devise critical ways to deal with benefits from these groundbreaking occasions.

Understanding the Nifty Option Chain in M&A Setting:

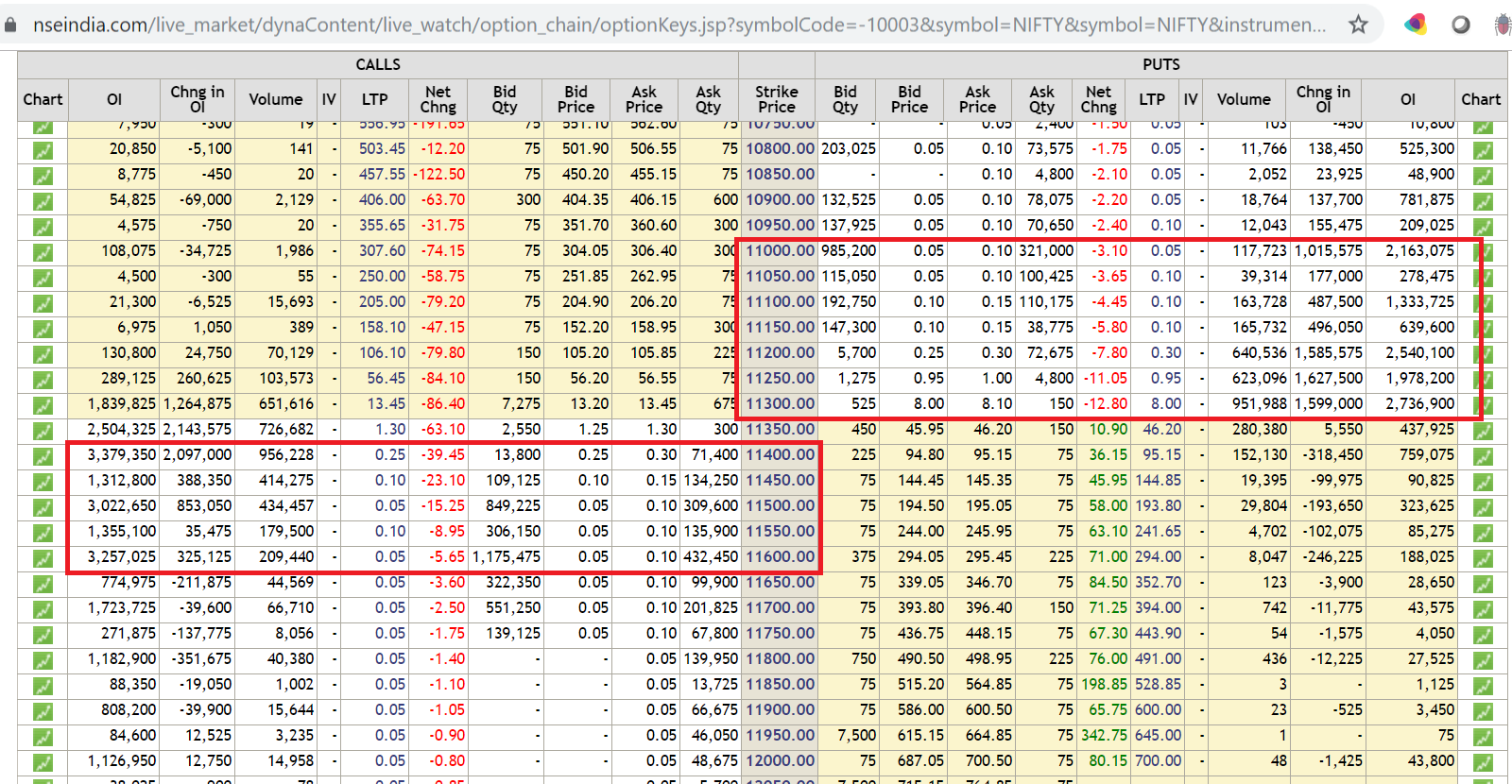

The Nifty Option Chain fills in as an extensive data set of choice agreements connected with the Nifty 50 record. This information incorporates bid and asks costs, open interest, volume, and other appropriate data for call and put choices at different strike costs and lapse dates. Regarding M&A, the choice chain becomes an incredible asset for checking market opinion, foreseeing potential value developments, and executing critical trading things.

Using the Nifty Option Chain for M&A Benefit Potential:

Recognize Designated Organizations: Remain informed about progressing or potential M&A bargains, including organizations recorded in the Nifty 50 file. A consolidation or procurement declaration can prompt expanded market unpredictability and changes in stock costs, setting out trading open doors.

Examine Unpredictability: M&A declarations frequently bring about expanded stock cost instability. This unpredictability is reflected in higher suggested unpredictability levels inside the choice chain. Merchants can distinguish contracts with raised inferred instability to possible profit from expanded choice charges.

Execute Ride System: The ride technique includes purchasing a call choice and a put option with a similar strike cost and termination date. This procedure benefits from huge cost developments in one or the other bearing. As M&A news can prompt significant cost swings, a very coordinated ride can be productive.

Follow Volume and Open Interest: Focus on changes in choice volume and open interest, particularly at strike costs close to the obtaining objective’s ongoing stock cost. Abrupt spikes in volume or available revenue can demonstrate expanded exchanging action and portend market opinion.

Screen Expiry Dates: Guarantee that the picked choice agreements align with the expected course of events of the M&A bargain. Assuming an obtaining is supposed to be finished within a particular time, select choice agreements that lapse around that period to gain by cost vacillations.

Remain Refreshed: Keep a nearby watch on news connected with the M&A bargain, as any updates or changes can influence stock costs and market feel. Convenient data can direct your exchange choices.

Risk The board and Contemplations:

Vulnerability: While M&A occasions can set out trading the open doors, they likewise bring a degree of exposure. Market responses to these occasions can be capricious, so knowing about possible dangers is essential.

Exhaustive Investigation: Cautiously survey the effect of the M&A bargain on the stock’s major and specialized perspectives. Thorough investigation can assist you with settling on informed choices.

Broadening: Enhancing your portfolio by integrating different trading systems can assist with moderating expected misfortunes from adverse market developments.

Utilizing the Nifty Option Chain to benefit from consolidations and acquisitions requests a mix of crucial understanding, timing, and hazards to the board. By checking inferred instability, breaking down exchanging volume, and executing reasonable choices techniques like rides, dealers can situate themselves to gain by cost swings because of M&A declarations.