Moving to a new address can be an exciting time, but it also comes with responsibilities, including updating your information with government agencies like the Canada Revenue Agency (CRA). Ensuring that the CRA has your current address is crucial for receiving important correspondence such as tax returns, notices, and benefit payments. Here are three effective ways to update your address with the CRA seamlessly:

1. Online through CRA My Account

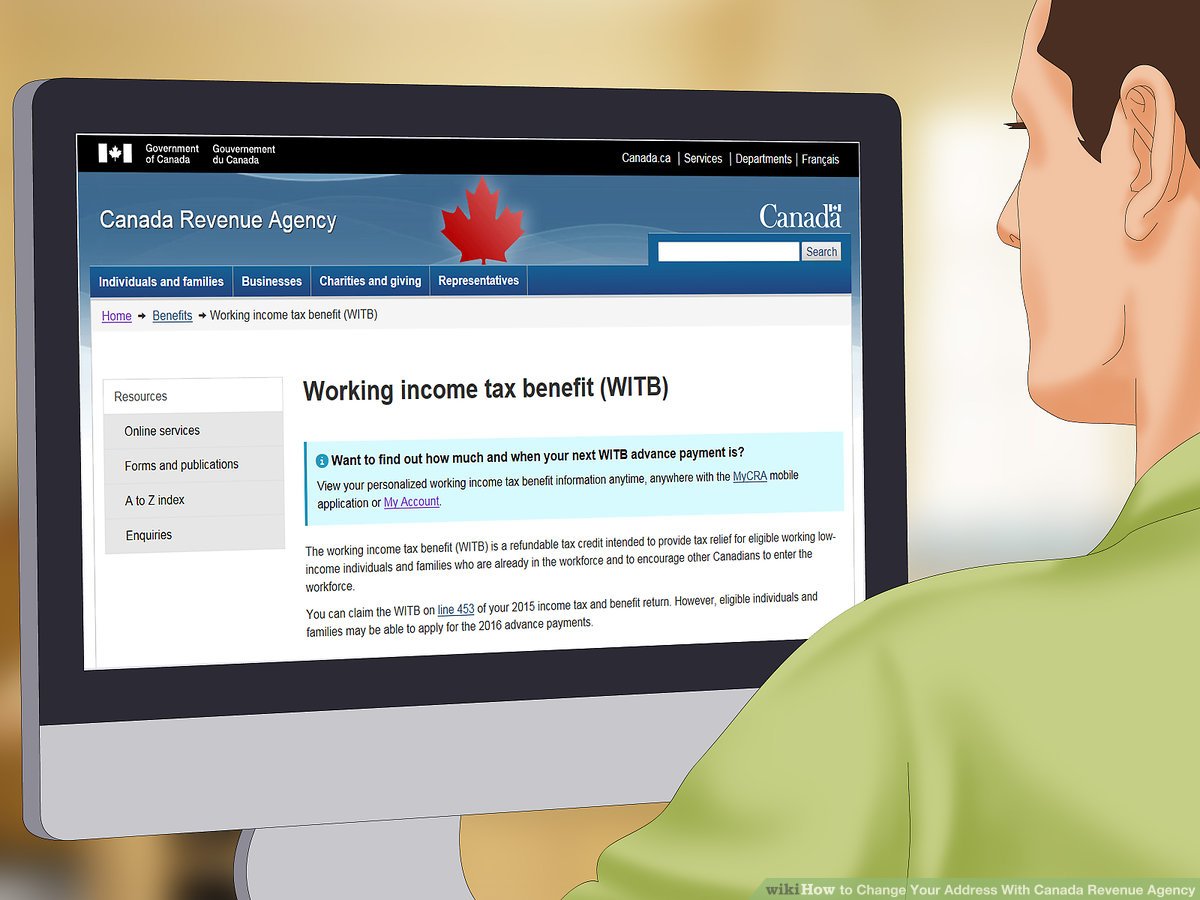

One of the most convenient methods to update your address with the CRA is through your CRA My Account. This online portal provides secure access to your tax-related information and allows you to manage your personal details, including your address. Here’s how you can do it:

- Log in to CRA My Account: Visit the CRA website and log in using your username and password. If you haven’t registered yet, you will need your social insurance number (SIN), date of birth, and other personal information to create an account.

- Navigate to the “Address” section: Once logged in, look for the section where you can update your address information. This is usually under a category like “Profile” or “Personal Information.”

- Update your address: Enter your new address details accurately. The CRA system may verify the address format against the Canada Post standards to ensure accuracy and delivery efficiency.

- Confirmation: After submitting your changes, the CRA will update your records. You may receive a confirmation email or notification once the update is processed.

Using CRA My Account is not only convenient but also ensures that your information is updated securely and promptly. Remember to keep your login credentials secure to protect your personal information.

2. By Phone

If you prefer to update your address with the CRA over the phone, you can do so by contacting their individual income tax inquiries line. Here’s how:

- Prepare your information: Before calling, gather your social insurance number (SIN), date of birth, and details of your new address.

- Contact CRA: Dial the CRA’s individual income tax inquiries line at 1-800-959-8281. Be prepared for potential wait times during peak periods.

- Speak with a representative: Once connected, inform the CRA representative that you need to update your address. Provide the necessary information accurately and follow any instructions given.

- Confirmation: The CRA representative will update your address in their system and may provide you with a confirmation number or details of the update.

Updating your address by phone is straightforward and ensures that your information is updated promptly. However, be cautious when sharing personal information over the phone and ensure you are speaking with a legitimate CRA representative.

3. By Mail with a Change of Address Form

For those who prefer traditional methods, updating your address with the CRA can also be done by mailing a Change of Address Form. Here’s how to proceed:

- Obtain the form: Download the RC325 form “Address change request” from the CRA website or pick up a copy from your local post office.

- Complete the form: Fill out the form accurately with your current information and the new address details. Ensure all fields are completed correctly to avoid delays.

- Include supporting documents: Depending on your circumstances, you may need to include supporting documents such as a copy of your identification (e.g., driver’s license) or proof of address (e.g., utility bill).

- Mail the form: Send the completed form and any supporting documents to the address specified on the form or to your tax centre. The address format should adhere to Canada Post standards to ensure proper delivery.

- Confirmation: The CRA will process your request upon receipt of the form and documents. You may receive a confirmation by mail once your address has been updated.

Mailing a Change of Address letter is a reliable method if you prefer not to use online services or phone calls. Ensure you use the correct address format to avoid any delays in processing your request.

Additional Tips for Updating Your Address:

- Notify other government agencies: Besides the CRA, remember to update your address with other relevant government agencies such as Service Canada and Elections Canada if applicable.

- Update financial institutions: Notify your bank, insurance providers, and any other financial institutions of your address change to ensure uninterrupted services and correspondence.

- Forward mail: Consider using Canada Post’s mail forwarding service to redirect your mail from your old address to your new one temporarily.

Conclusion

Updating your address with the CRA is a crucial step to ensure you receive important tax-related information and benefits promptly. Whether you choose to update it online through CRA My Account, by phone, or by mailing a Change of Address Form, ensuring accuracy and timeliness is key. By following these methods, you can navigate the process smoothly and enjoy your new address with peace of mind.

For more information on writing a change of address letter, visit PostGrid’s policy change letter guide. To understand the correct Canada address format, refer to PostGrid’s Canada address format guide.

Stay informed and proactive with your address updates to ensure seamless communication with the CRA and other relevant authorities. Happy moving!