In the realm of insurance claims, understanding the differences between no-fault and at-fault insurance systems can significantly impact the outcome of your claim and the compensation you receive. Whether you’re involved in a car accident lawyer, a personal injury incident, or property damage, the type of insurance system in place in your state plays a pivotal role in determining how your claim is processed, who pays for damages, and the legal implications involved. This article delves into the core aspects of both no-fault and at-fault insurance systems, highlighting their key differences and their respective impacts on insurance claims.

No-Fault Insurance System: Overview And Benefits

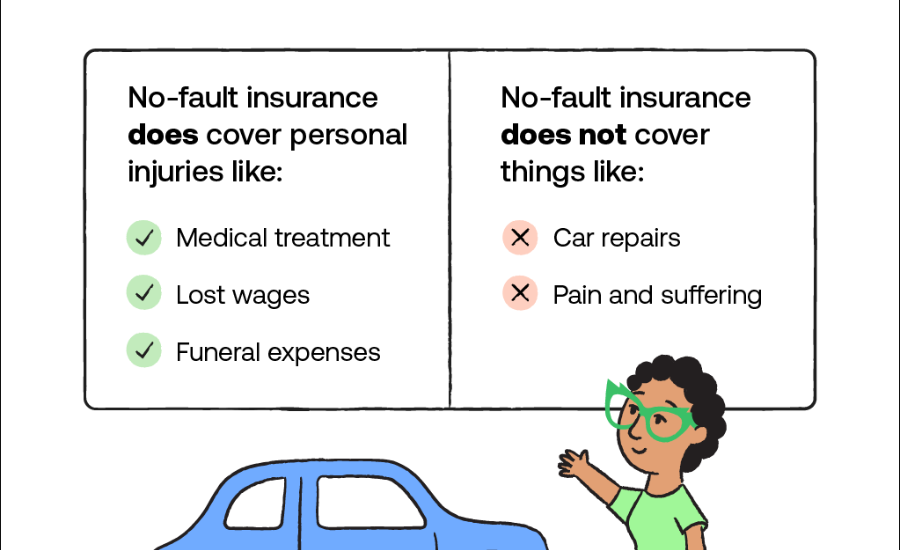

The no-fault insurance system operates under the principle that each party involved in an accident is compensated by their own insurance company, regardless of who was at fault. This system aims to streamline the claims process and reduce litigation by providing prompt compensation to policyholders. Key features of the no-fault insurance system include:

1. Direct Compensation: Under no-fault insurance, your own insurance company compensates you for medical expenses, lost wages, and other specified damages, regardless of fault. This ensures that you receive timely assistance without having to prove the other party’s negligence.

2. Limited Right to Sue: In states with no-fault insurance laws, there are restrictions on when you can sue for damages beyond what your insurance covers. Typically, lawsuits are permitted only in cases of severe injuries or when certain monetary thresholds are exceeded.

3. Premium Stability: Proponents of no-fault insurance argue that it helps stabilize insurance premiums by reducing the frequency of lawsuits and the associated legal costs.

At-Fault Insurance System: Overview And Legal Implications

Conversely, the at-fault insurance system, also known as tort liability insurance, relies on determining fault and liability following an accident. In this system, the party deemed responsible for the accident is liable for damages to the other party/parties involved. Key aspects of at-fault insurance include:

Liability Determination: Insurance companies investigate accidents to determine who was at fault based on factors such as negligence, traffic laws, and other relevant circumstances. The at-fault party’s insurance typically covers damages for the other party.

Unrestricted Right to Sue: Unlike no-fault systems, at-fault insurance allows injured parties to pursue legal action against the responsible party for damages not fully covered by insurance, including pain and suffering, emotional distress, and punitive damages in some cases.

Variability in Compensation: Compensation in at-fault systems may vary based on the degree of fault assigned to each party. States may adhere to either pure comparative negligence, where compensation is reduced by the percentage of fault assigned, or contributory negligence, where any fault assigned to the injured party can bar them from recovering damages.

Choosing Between No-Fault And At-Fault Insurance Systems

The choice between no-fault and at-fault insurance systems often depends on state laws and regulations governing insurance. States in the U.S. can adopt either system, with some offering a choice between both. Factors to consider when determining which system is more advantageous include:

Legal Environment: Understanding your state’s legal framework and how it influences insurance claims and lawsuits is crucial. States with no-fault systems may limit litigation but could restrict your ability to sue for certain damages.

Cost Considerations: Evaluate the cost implications of insurance premiums under both systems. No-fault insurance may offer more predictable premium costs, while at-fault insurance could result in higher premiums depending on the frequency of lawsuits and settlements.

Personal Risk Tolerance: Assess your tolerance for financial risk and the potential for out-of-pocket expenses. No-fault insurance provides immediate benefits but may limit your ability to seek compensation for non-economic damages in certain circumstances.

Medical Coverage And PIP Benefits:

Under a no-fault insurance system, Personal Injury Lawyers benefits are often mandatory. PIP coverage provides immediate medical expense coverage for injuries sustained in an accident, regardless of fault. This feature ensures that policyholders can quickly access necessary medical treatment without waiting for fault determination or the resolution of legal proceedings.

Coordination of Benefits:

In states with no-fault insurance, there are regulations concerning the coordination of benefits when multiple insurance policies cover the same incident. This coordination helps prevent overpayment and ensures that policyholders receive appropriate compensation without duplicating benefits.

Impact on Insurance Rates:

The structure of no-fault and at-fault insurance systems can influence insurance premiums differently. No-fault systems may lead to more stable premium rates due to reduced litigation and quicker claims processing. In contrast, at-fault systems may result in higher premiums in regions with more frequent and costly lawsuits.

Legal Thresholds for Lawsuits:

States with no-fault insurance often establish thresholds that determine when an injured party can pursue legal action against the at-fault party. These thresholds may be based on the severity of injuries, medical expenses exceeding a certain threshold, or permanent impairment. Understanding these thresholds is crucial for policyholders considering legal recourse beyond their insurance coverage.

Fault Determination Challenges:

In at-fault insurance systems, determining fault can sometimes be contentious and involve extensive investigations. Factors such as witness testimonies, police reports, and forensic evidence play pivotal roles in establishing liability. This process can prolong the resolution of claims and may necessitate legal representation to protect policyholders’ interests.

Insurance Policy Limits And Coverage Extensions:

Both no-fault and at-fault insurance policies have limits on the amount of coverage they provide for various types of damages. Policyholders should review their insurance policies carefully to understand these limits and consider additional coverage options, such as umbrella insurance, to protect against potential gaps in coverage.

Comparative Negligence And Contributory Negligence:

At-fault insurance systems may operate under principles of comparative negligence or contributory negligence, impacting the compensation available to injured parties. Comparative negligence reduces damages based on the degree of fault assigned to each party, whereas contributory negligence may completely bar recovery if the injured party is found even partially at fault.

Public Perception And Legal Reforms:

Public perception and political considerations can influence the adoption or modification of no-fault and at-fault insurance systems. Legal reforms aimed at reducing insurance fraud, improving claims processing efficiency, or enhancing consumer protections may lead to changes in insurance laws and regulations over time.

Conclusion

Navigating the complexities of insurance claims under either no-fault or at-fault systems requires a clear understanding of each system’s advantages, limitations, and legal implications. Whether you reside in a state that mandates no-fault insurance or allows you to choose between systems, being informed about your coverage options and rights can empower you to make sound decisions following an accident or injury. By weighing the benefits of streamlined compensation versus the potential for broader legal recourse, individuals can better protect their interests and secure the appropriate insurance coverage for their needs.

Subscribe for the latest news and alerts. Internal Insider!