In a world marching steadily towards the fourth industrial revolution, every individual and institution demands innovative solutions to meet their ever-evolving needs.

Specializing in personalized software applications and Cloud Consulting services, and Cloud Computing Services Internet Soft, a banking software development company, provides scalable and flexible solutions for the banking industry.

Cloud Computing

Cloud computing, in simple terms, is the availability of computing services over the internet. Unlike the conventional ITf infrastructure, involving physical management of hardware, purchasing of heavily priced software licenses, and incurring maintenance costs, cloud computing allows easy access to computing services like storage infra, databases, applications, services, and custom software development over the internet through remote servers. It has emerged as a cost-effective transformation in digital technology, allowing for scalability and flexibility.

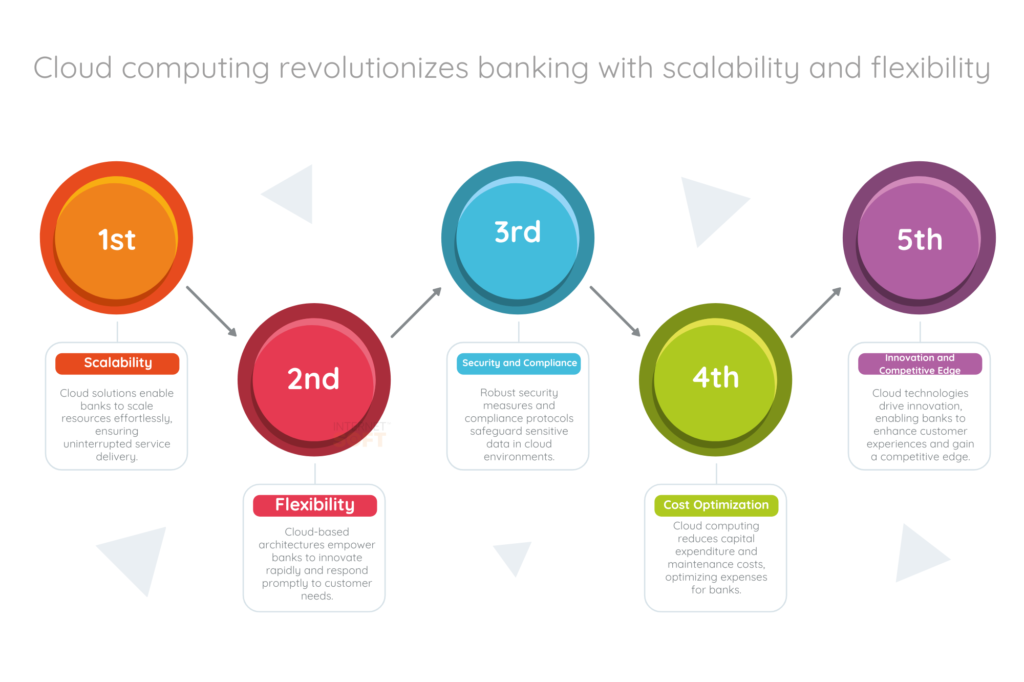

Cloud Computing Revolutionizing the Banking Industry

Quick access to the required resources, rapid deployment of applications, and scalable solutions have led to a major cloud-based transformation of the banking sector. It has majorly elevated the data storage and processing functions of the banks through agile banking software development services.

Scalability

The feature of scalability primarily heeds to the real-time demands in the banking sector. The banking facilities need to be top-notch, allowing for work fluctuations and demand spikes without compromising on the performance aspect. Cloud computing facilitates the access of resources (both less and more) based on the demand situation. The resources can include the need for storage, bandwidth, and processing capability.

Flexibility

Being in a customer-centric industry like banking, it is paramount to adapt to the changing market trends. Besides, it is also very crucial to be prompt in addressing customer problems, launching new products/services, and providing new & relevant features. Cloud computing services offer such flexibility to build modular and customizable software systems that can also be upgraded without any service disruption.

Cost Reduction

Cloud computing eliminates the need to invest in software licenses or hardware resources. It also frees from the worries of maintenance costs, as there are auto updates and upgrades from the service providers, allowing for always up-to-date technology infra. Overall, it allows for cost-savings while enhancing performance.

Cybersecurity

Banking is by far the most data-sensitive industry, and it holds information on the personal and financial data of millions of customers. Hence, it is essential to secure this information from cyber threats. Cloud environments, which use remote servers for data handling have robust compliance protocols and security measures in place to safeguard such sensitive data. The setup allows for more stringent data encryption, disaster recovery process, and access control measures. Internet Soft software computing services, through the adherence to industry-standard regulations like GDPR, ensure secure implementation of applications through cloud computing.

Innovation

A drive for innovation is the basis of all the technological transformations to date. Leveraging cloud computing can enable the development of new applications, deployment of market-relevant services, and accelerating the available-in-market time of such applications and products.

Agility

The faster rollout of features, and applications, catering to ever-demanding consumer needs, enables agility in the banking sector. Through this the banks can gain a competitive edge in the market.

Better Connectivity

Cloud-based services ensure better connectivity and collaboration between different banks and bank branches across geographical locations, thereby empowering them to share loads of information in real-time.

Banks Embracing Cloud-Based Systems

Migration of an industry like banking to cloud-based systems requires a well-formulated strategy that encapsulates all the business aspects, compliance measures, and security requirements.

- Phased Manner – To ensure minimum disruption and smooth transition, the migration should happen in a phased manner. The initial phase should involve non-critical applications. Once thoroughly satisfied with their performance post-migration, we should go ahead with the critical applications.

- Hybrid Model – To balance the security concerns with the benefits of agility, scalability, and flexibility, many banks follow a hybrid cloud approach. This involves critical applications to remain on-premise, whereas less sensitive data to migrate to remote servers.

- Security Measures – Banks must ensure that all required security measures like access controls, data encryption, and industry-relevant security protocols are in place before the migration. Moreover, the data governance policies must be implemented for securing sensitive information.

- Data Regulations – A thorough inspection is required before selecting your cloud providers. They must hold the required compliance certifications and adhere to data regulations of the finance sector.

- Skilled Workforce – Mere installation and migration to services isn’t enough. A skilled and thoroughly trained workforce is also required to manage these cloud-based applications. The IT staff need to have the required expertise for handling the operation through these services.

- Operation Management – The entire shift to a novel system would require advocacy to the staff about its benefits. All stakeholders, including employees and customers, might need duly and relevant information pertaining to this adoption.

- Partner Selection – Well, this is the primary aspect, however, being discussed in the end). To ensure a seamless process transition, it is very much required to select and partner with a trusted and reliable cloud provider. They must have a reputable track record in the management of financial services. These must cater to all your above needs and offer a proper communication channel for all concerns.

To Summarise All!

Better collaboration & connectivity, scalability, flexibility, reduced costs, innovative approach, and robust security are some of the advantages that cloud computing services have offered in the banking industry. In a nutshell, these services are persistently reshaping the industry for the digital era customers. The system is continually evolving to manage complex data processing requirements.

Internet Soft, a leading software development company in California, USA, addresses challenging software requirements through the adoption of cutting-edge cloud-based services and technologies.

Don’t miss out on updates and alerts – stay connected! Internal Insider